Rockingham County Tax Department News:

Rockingham County Tax Administration has updated their website at http://www.

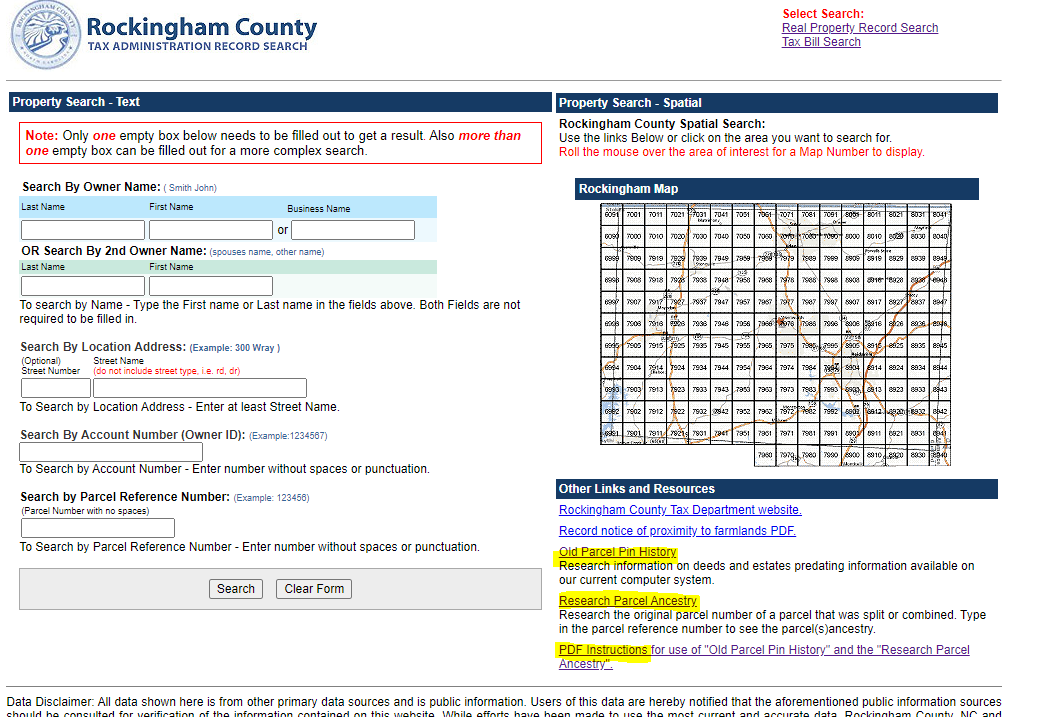

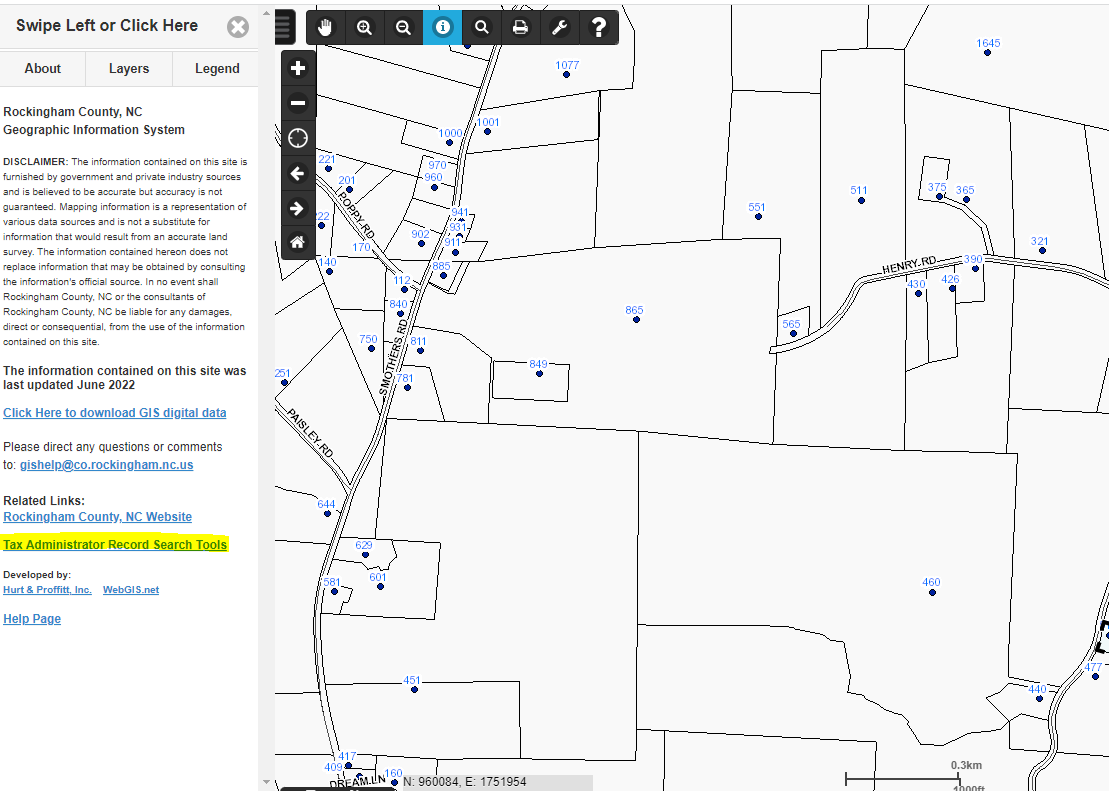

The last couple of years have reinforced the need for all of us to be able to research outside of normal business hours. Rockingham County Tax Administration has added 2 new links to our Property Record Search dashboard. Rockingham County GIS has also added these links.

Instructions for use are located with the links.

Old Parcel Pin History has information on deeds and estate references that was retrieved from archived hand written records predating information available on our current computer system and property cards.

Research Parcel Ancestry allows you to see the original parcel number of a parcel that has been split or combined into other parcels(s). Type in the parcel reference number to see the parcel(s)ancestry.

If you need assistance with the site or would like to make a suggestion, please direct your response to the following email address:

![]() taxadm@rockinghamcountync.gov

taxadm@rockinghamcountync.gov